Offload Annual Filing So You Can Focus on Fundraising

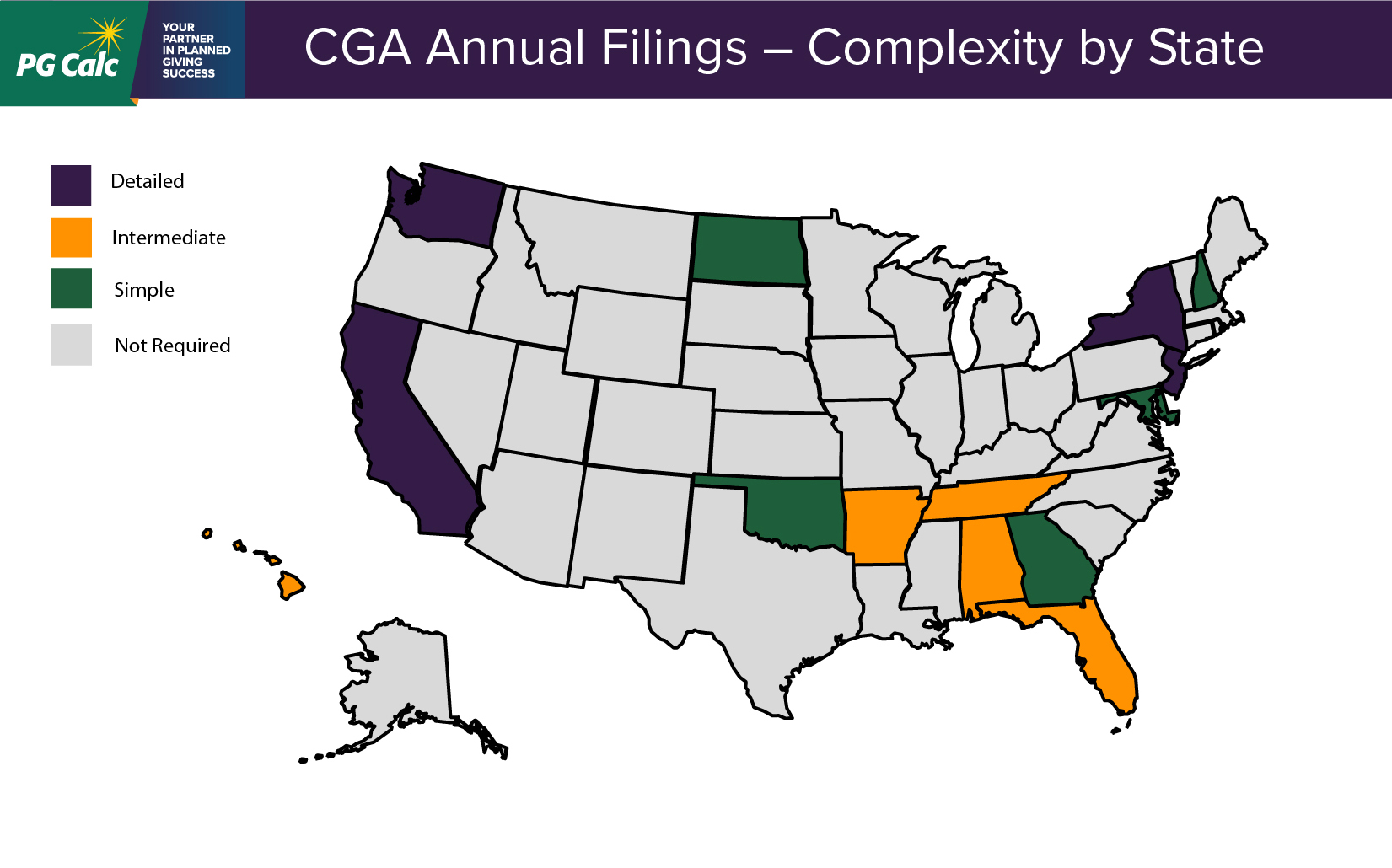

There are many ongoing requirements that an organization must meet once it has registered to issue gift annuities, and the nature of annual reporting varies by state. We spend the time tracking deadlines and documents, so that you don’t have to.

While there is the risk of fines in not meeting annual filing deadlines, the primary importance of the filings is maintaining compliance with the law. We ensure timely filings, so that you’re not at risk for losing your exemption from (and then becoming subject to) a state's full insurance code.

State Map

As of November 2020

What It's Like to Work With Us

We manage the process, keeping you updated along the way. You’ll know what’s coming, what’s in process, and what’s been completed – giving you peace of mind.

We’ll discuss your organizational structure so that we can best facilitate the collection of information.

Based on the states in which you are registered, as well as your fiscal year end, we’ll create a compliance grid for the year.

We’ll have to ask you for certain information, but then we take it from there. You won’t have to handle the forms except to obtain the appropriate signatures and submit to the states – and in many instances we’re able to handle the submission for you!