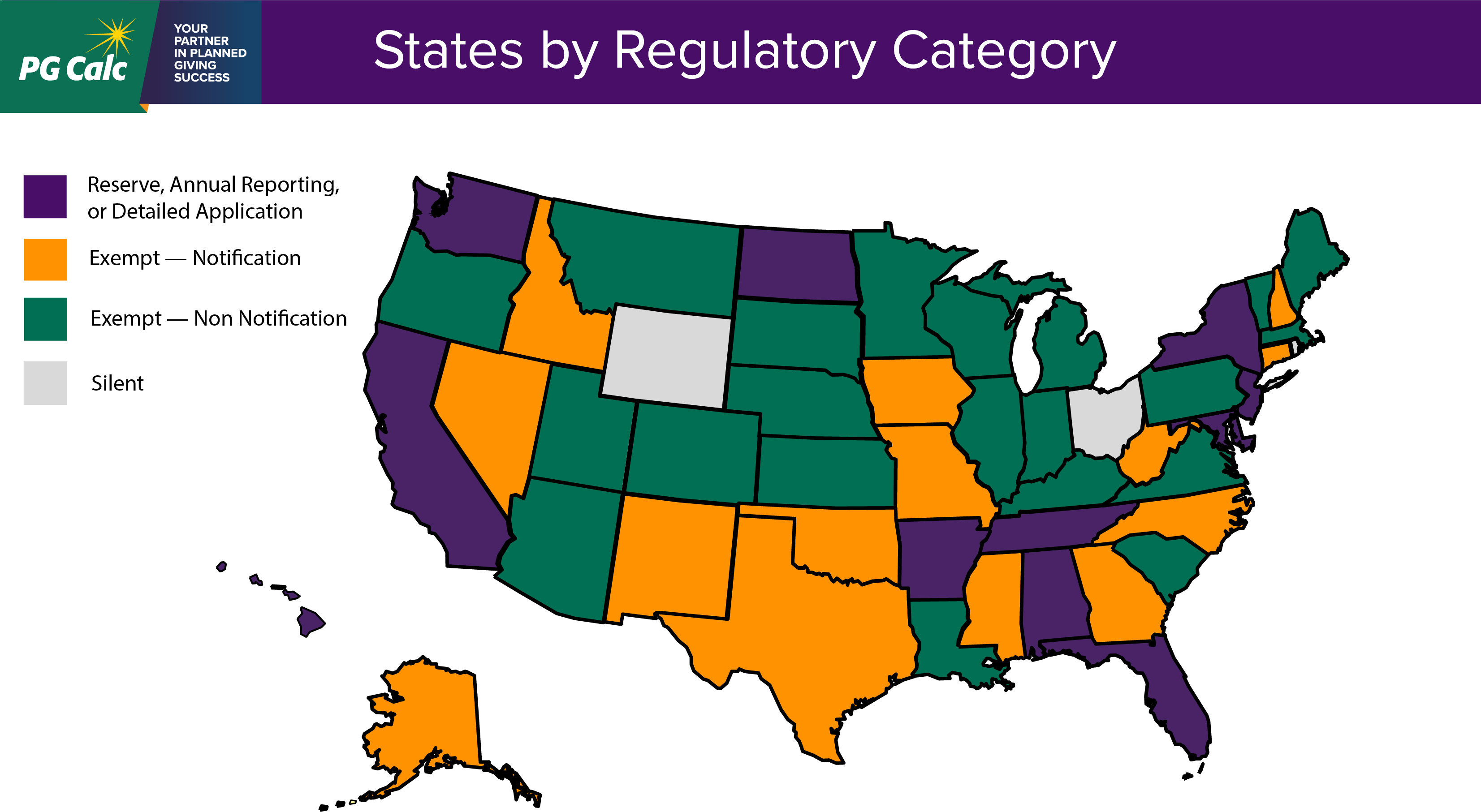

Solve the State Registration Puzzle

Instinct might suggest you offer gift annuities in as many states as possible, but sometimes the risks outweigh the rewards in certain states. We help you consider your options for where and when you offer these gifts.

State Map

As of April 2021

Fees For State Registration Services

The first fee is applicable if your organization has not issued CGAs in the corresponding state; the second is applicable if you have already issued in the state (for some states the two fees are the same).

| State | No Existing CGAs in State |

Previously Issued CGAs in State |

|---|---|---|

| AL | $900 | $900 |

| AR | $900 | $900 |

| CA | $2,250 | $3,5001 |

| FL | $550 | $550 |

| HI | $700 | $700 |

| MD | $1,400 | $1,800 |

| ND | $700 | $700 |

| NJ | $1,875 | $1,8752 |

| NY | $1,550 | $2,3001 |

| TN | $900 | $900 |

| WA | $1,800 | $2,5001 |

| AK CT GA ID IA MS MO NV NH NM NC OK TX WV |

$2,000 (all 14) | $2,000 (all 14)3 |

1 Assumes up to 5 existing contracts issued in the state. If more than 5 contracts, see schedule below.

CA: $25 per additional CA contract

NY: $15 per additional NY contract

WA: $15 per additional WA contract

2 Annual statement required; PG Calc can prepare for additional cost (pricing varies; please inquire for details).

3 Pricing for all 14 notification states; if less than all, $275 for one state, and $150 for each additional.

| State | No Existing CGAs in State | |

|---|---|---|

| CA | $4,656* | |

| TN | $675 | |

| NJ | $100 | |

| ND | $100 | |

| WA | $25 | |

| AL (per agent) | $70 |

* The total application fee with the registered agent fee is $4,735 for non-CA charities.

What It's Like to Work With Us

We work closely with you to help you navigate these murky waters. Our staff of experts will ensure that you are in compliance.

Discover what you don’t know. The first step in state registration isn’t filling out a form– it’s talking to an expert about the benefits and costs associated with gift annuity state registration. Working with us ensures you are in compliance with state regulations and will avoid unnecessary work and costly fees. Our state registration consultants, led by nationally recognized expert Edie Matulka, have a unique wisdom about the nature of the regulatory process.

We'll talk with you about which state regulations will be applicable for your organization.

Together we'll develop a plan for registration, notifications, and any issues that may crop up.

We’ll have to ask you for certain information, but then we take it from there. You won't have to handle the forms except to obtain the appropriate signatures and submit to the states - and in many instances we're able to handle the submission for you!