Most gift planning professionals have heard of charitable lead trusts (CLTs), where the charitable beneficiary receives payments, typically for a term of years, and the remainder is distributed to one or more non-charitable beneficiaries at the end of the term. Historically, these trusts have been used – or at least contemplated – by donors whose wealth exposes them potentially to paying gift or estate tax. This type of lead trust is called a non-grantor charitable lead trust. At the end of the term, the assets remaining in the trust are distributed to persons other than the donor (grantor), and most typically, to members of the donor’s family.

There is another type of charitable lead trust, which is like the non-grantor trust in many ways, but the trust corpus remaining at the end of the term is distributed back to the donor instead of to the donor’s heirs. This type of trust is called a grantor charitable lead trust. The grantor version makes distributions to one or more charitable organizations during its term, as does the non-grantor trust version, but because the remainder goes back to the donor, the trust is treated quite differently for tax purposes. While the donor of a non-grantor CLT receives a gift or estate tax charitable deduction for the present value of the estimated benefit to charitable entities, the donor of a grantor CLT receives an income tax charitable deduction for the present value of the estimated charitable benefit.

Important Tax Considerations

This is an important characteristic of the grantor charitable lead trust: while the donor receives an income tax deduction up front for the present value of the future distributions to charity, the donor does NOT receive any additional income tax deductions for distributions made to charities over the term of the trust. Keep in mind, even though the donor’s assets have been transferred into the grantor CLT, they continue to function as if they are still the property of the donor throughout the operation of the trust. This means that the income earned from those assets is treated as the donor’s income over the years of the trust. Also, any capital gains realized in the trust are treated as if they were realized by the donor; hence, the donor of a grantor charitable lead trust is taxed on both the income earned in the trust and the capital gains realized in the trust each calendar year.

This tax treatment is in stark contrast to the way distributions, income, and realized gains are treated in a non-grantor CLT. In that version, the trust itself pays any taxes due on the income earned and the capital gains realized each calendar year (the trust is a taxable trust). But the taxable income and realized gains each year are offset by the amount of the trust’s distributions to charities; as long as the income and gains do not exceed the total amount of charitable distributions, the trust will pay no tax.

Why Set Up a Grantor Charitable Lead Trust

So why, you might ask, would a person set up a grantor charitable lead trust, at least from a tax-efficiency point of view? If the tax aspects are the driving motivation, a donor would set up a grantor CLT specifically for the income tax deduction up front. A person who has significant and unusual taxable income in a particular year can establish the grantor lead trust and use the charitable income tax deduction to mitigate the impact of taxes in his or her situation. A fanciful example might be someone who has received an unexpected windfall, such as winning a lottery jackpot; those winnings will be fully taxed as ordinary income. A far more common and likely example is someone who has sold a business, or someone who has received an unusual one-time boost in earnings. These situations will trigger an unusually large amount of tax, because the profits or earnings will be taxed as ordinary income at the highest possible marginal tax bracket.

It should be noted that the extent to which the donor can use the income tax deduction in any particular year will be limited to a portion of his or her total income for the year – up to 30% of adjusted gross income (AGI) for cash-based deductions and up to 20% of AGI for deductions based on gifts of long-term gain assets. In addition, the donor can claim unused portions of the deduction in up to 5 additional carry-forward years.

Impact of Tax Reform

Since the passage of the 2017 Tax Cuts and Jobs Act, there is greater incentive for donors to create grantor CLTs. These trusts allow donors to consolidate deductions for future donations into a larger deduction for a single year. Against the backdrop of the increased standard deduction and new limitations on deductions for state and local taxes (SALT), and the elimination of many other deductions, grantor CLTs provide significant benefit to taxpayers who itemize. In some instances, creating a grantor CLT may enable a donor to itemize who otherwise would be better off taking the standard deduction.

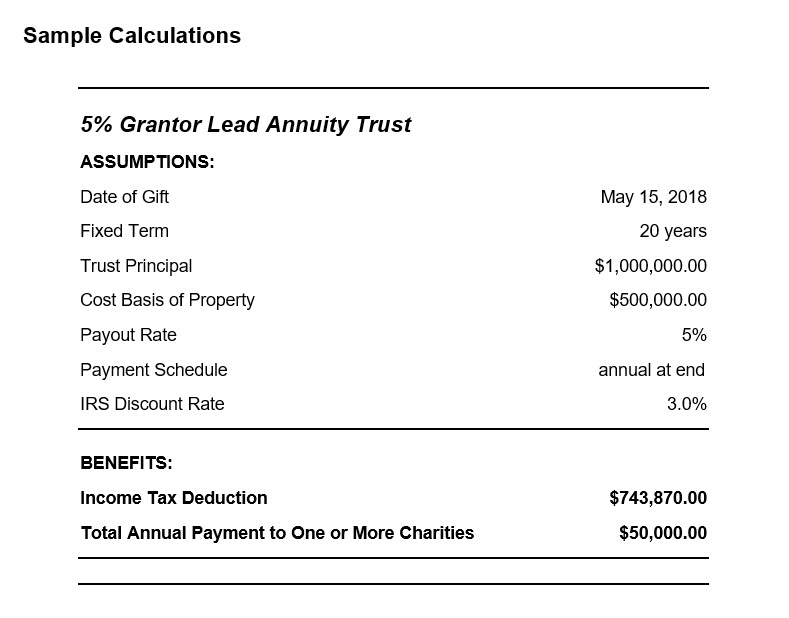

What do the numbers look like for a sample grantor charitable lead trust? Let’s say the donor wants to transfer $1 million of appreciated assets into a charitable lead annuity trust (CLAT) that will run for 20 years and distribute 5% of the original funding value each year to charitable organizations. After the 20 years, the assets remaining in the trust will distribute back to the donor. At the time of this article, the lowest IRS discount rate available is 3% for March of 2018 (with CLTs, the lowest available IRS discount rate produces the highest deduction amount).

These numbers are quite compelling. The charitable income tax deduction is approximately 74% of the total funding amount. And with decent investment management over 20 years, the donor should be able to receive much, if not all, of the original funding amount back. The past several years, in fact, have been especially favorable to charitable lead trusts, because of the inverse relationship of the discount rate to the charitable deduction. The discount rate is starting to tick back up, in concert with the general rise in interest rates, but donors still have time to take advantage of the historically low discount rates.

The Grantor Charitable Lead Unitrust Alternative

The donor might also consider establishing a grantor charitable lead unitrust (CLUT), instead of a CLAT. As with the charitable remainder trusts, the grantor charitable lead annuity trust features a fixed dollar payout amount that never changes over the years of the trust’s operation; the unitrust version, in contrast, has a fixed percentage payout rate, and the annual distributions to one or more charities are re-calculated each year based on the official annual re-valuation of the trust’s assets. The charitable deduction for the unitrust version, however, is less than that for the annuity trust version. In our example above, the deduction would drop to $630,360, based on all other assumptions remaining constant.

More Reasons to Set Up Grantor CLTs

There are, of course, other reasons to establish grantor CLTs besides the significant up-front deduction. The most important one is the motivation on the part of the donor to make significant gifts to the charity or charities of his or her choice. Like the non-grantor charitable lead trust, the grantor CLT provides a vehicle through which to make large distributions annually to charitable organizations while still directing the ultimate disposition of any remaining assets at the end of the term.

In PG Calc’s Client Services group, we’ve received a surprising number of inquiries in recent months about grantor CLTs. We’ve learned that there are certain donors considering these trusts as ways to ensure a guaranteed stream of support for their favorite causes over extended periods of time. In our example above, assuming the trust stays afloat with adequate investment results, one or more charitable organizations will receive $50,000 each year for the next 20 years. Were that to be directed only to one organization, it might be enough to facilitate a specific endeavor within the organization, such as a named scholarship or endowment fund.

In fact, some of our recent conversations with clients have involved using charitable lead trusts to pay off significant campaign pledges. In these cases, the donors and charities have been discussing shorter term grantor CLTs, such as for 5 - 7 years, with much higher payout rates of 10% or greater. These trusts can serve as excellent vehicles to enforce larger commitments as part of major fundraising endeavors.

The Right Solution for the Right Donor

Having said all of that, we should note that the grantor charitable lead trust, like CLTs in general, is likely to remain an exception in the world of split interest charitable gift arrangements. Unlike charitable gift annuities, and even charitable remainder trusts, the unique characteristics of grantor CLTs will appeal only to donors who are in a position to direct at least several hundred thousand dollars of cash or other assets into a trust. This is a very small portion of any organization’s donor base. While non-grantor charitable lead trusts help to address the challenges of persons having too much wealth during life and at death, grantor CLTs help to deal with the problem of having too much taxable income in a specific calendar year. Both of these situations are relatively rare, but it’s good to have an understanding of the vehicles that can work best under such unusual circumstances.

Remember, We Are Here for You

We hope you found this article helpful. We’re always glad to hear from you, and we’d love to help you with any conversations you’re having with donors about possible charitable lead trusts. We’ll help you run the calculations and projections and try to answer any questions you might have. After all, you never know what the next donor call will be about!

Comments

Grantor CLTs

Reid - it seems to me that the sharkfin / balloon version would tend to favor the grantor of the trust, or the remainder beneficiaries in a non-grantor trust, because the corpus is allowed to grow much more over a longer period of time than compared to a standard payment format. I don't know that the benefit is any worse for the charitable organization, but charities tend to be fairly passive in the overall process of structuring these trusts anyway. So you might find potential donors more interested in CLTs if you show them comparisons between standard-payment and sharkfin / balloon versions. Thanks. - Jeffrey Frye

Grantor CLT trust question

The charitable distributions within a nongrantor CLT serves to offset the income and realized capital gain of the trust. Does this same dynamic exist for the grantor CLT?

Grantor CLTs

Kevin - good question - the same dynamic does not exist for the grantor CLT. With the grantor version, the donor receives a large income tax deduction up front, which represents the estimate of the total payments that will be made to charitable organizations over the life of the trust (discounted back to present value). Since the charitable deduction is received up front, there are no additional deductions or tax credits for the charitable distributions as they are made. But in contrast, the income earned and capital gains realized are taxed for each calendar year. So the donor gets the benefit of the charitable deduction up front, and has to pay tax on income and gains over the years of the trust. Hope this is helpful! - Jeffrey Frye

Grantor Charitable Lead Trusts

Thanks so much for this article. I've been in the charitable gift-planning world now for almost 20 years and have NEVER run across this option. I can see that in some cases it is a compelling alternative.

Best

Grantor CLTs

Baruch - thanks for your comment - I'm glad you enjoyed the article. Grantor CLTs have never been plentiful, because they make the most sense for the handful of individuals who find themselves in a windfall situation for a particular calendar year - a windfall, I might add, that is highly taxable. Since last year's tax reform, there is markedly less interest in the non-grantor CLT (because the estate tax threshold is now roughly $11 million for individuals and $22 million for married couples), so it makes sense that gift planners are looking a little more closely at the grantor versions of CLTs. Let us know if we can help you with one! - Jeffrey Frye

Termination

Hi, so this might be a rookie question but if the charitable lead trust runs out of funding before the specified terms does the donor have to recapture charitable deductions initially taken?

Documentation by charity of receipt of donation from CLAT

Does charity receiving donation from CLAT have to comply with substantiation rules generally applicable to gifts from individual donors?

Jeffrey (and/or other practitioners with knowledge in this area) -

What are your thoughts about the sharkfin lead trust, for both grantor and non-grantor variations.

Thanks!

Reid McLean