It is no secret that the American Council on Gift Annuities (ACGA) recently increased its suggested maximum annuity rates. The new rates, which went into effect on January 1, 2024, marked the third increase in the ACGA rates in the previous 18 months. At typical annuitant ages, the current rates are roughly 1.5% higher than they were in June 2022. For example, the ACGA rate for a 75-year-old annuitant was 5.4% in June 2022 and is 7.0% today.

The larger story is that the 2024 ACGA rates are the highest they’ve been in 15 years. In response to the Great Recession of 2008 and 2009, the ACGA lowered its suggested maximum rates twice in seven months, reducing them to some of their lowest rates ever up to that point. Its rates fluctuated now and then over the next 11 years but stayed at historically very low levels throughout this period. Then COVID struck and the ACGA revised its rates downward to unprecedented levels. From mid-2020 through mid-2022, the ACGA’s rates were the lowest they had ever been in the 95 years the ACGA had been publishing suggested annuity rates. Only after the latest of the ACGA’s three recent increases have the ACGA’s rates finally returned to their levels before 2/1/2009.

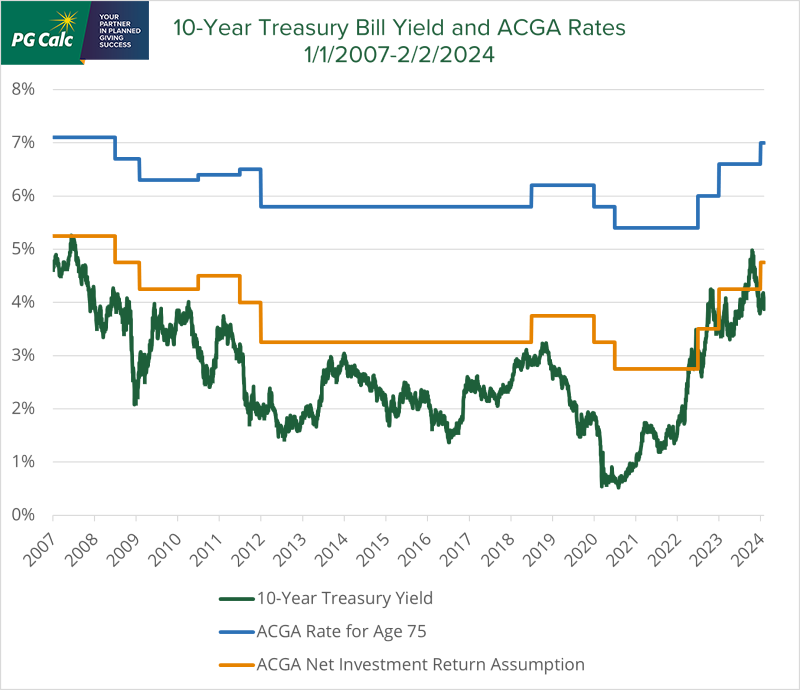

While the Great Recession and COVID pandemic were indirectly responsible for the very low and then lowest ever ACGA rates that prevailed in 2008-2022, the more direct cause was interest rates, specifically the yield on 10-year Treasury Bills. The graph below compares the yield on 10-year Treasury Bills, the net investment return assumption underlying the ACGA rates, and the ACGA rate for a 75-year-old during the years 2007-2023.

You can see that all three rates have moved largely in unison, although the ACGA rates change infrequently rather than daily, and when they do change, they tend to move up or down somewhat less than the yield on 10-year Treasuries, especially when the 10-year Treasury yield is changing rapidly. For example, when the 10-year Treasury yield plummeted in the first half of 2020, ACGA rates decreased less dramatically. Likewise, when it rebounded strongly in the second half of 2020 through late 2022, ACGA rates also increased, but more slowly.

What May the Future Hold?

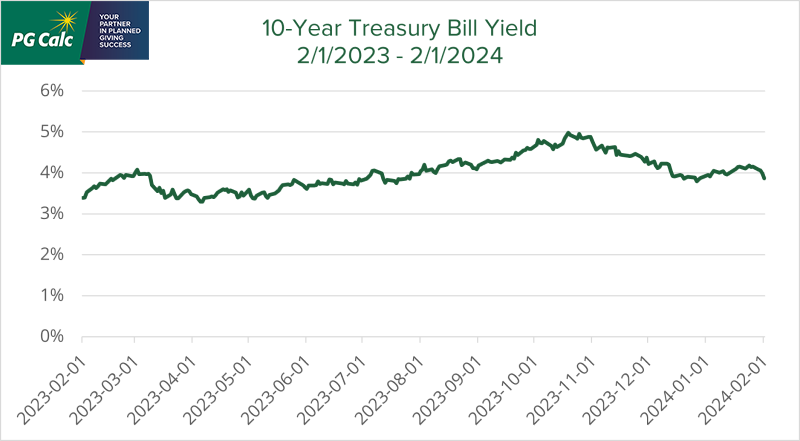

The yield on 10-year Treasuries peaked at a hair below 5% in mid-October 2023 and has settled in at around 4% for the last two months. See the graph below for its movement over the last year.

Jerome Powell, Chairman of the Federal Reserve, has said he expects the Fed to lower interest rates three times during 2024, now that inflation is approaching its target rate of 2%. Should the Fed fulfill those expectations, we would expect the yield on 10-Year Treasury Bills to follow suit and decline further as well.

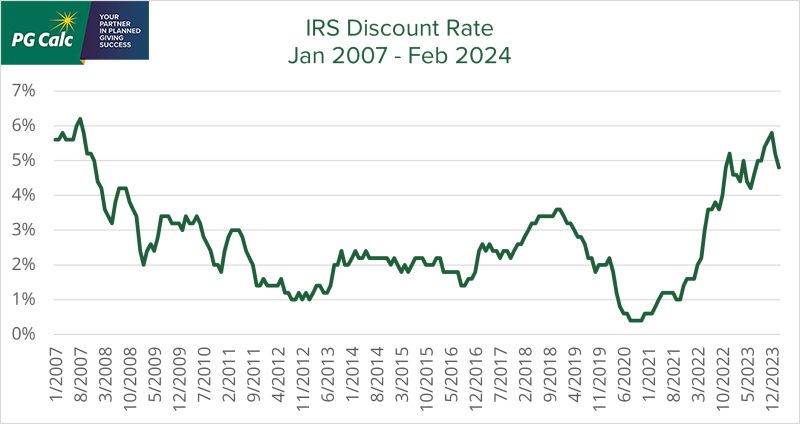

Here’s one more graph. It shows the monthly IRS discount rates since the beginning of 2007. These are the rates used to compute deductions for gift annuities and other planned gifts. They move almost in lock step with the 10-Year Treasury Bill yield, which shouldn’t be surprising since they are based on the yield of government bonds with maturities of 3-9 years. Like the ACGA rates, IRS discount rates were very low for a very long time. It is only in the last year or so that they have approached their level in 2007.

Now, the IRS discount rate is headed down again. It was 5.8% in December 2023. It is 4.8% just two months later. We don’t expect it to continue declining at that pace, but if interest rates decline generally over the course of the year as the Fed expects, the IRS discount rate will, too. Note that the lower the IRS discount rate, the lower the deduction for a gift annuity.

What Does All This Mean for Gift Annuities?

If you’re a donor, gift annuities look more attractive today than they have in a long time. Their payment amounts are higher than they have been in 15 years. Similarly, their deductions are higher than they’ve been since before the Great Recession. (There is one trade-off with higher IRS discount rates. A higher IRS discount rate means a lower tax-free portion of the annuity. For this reason, donors who don’t itemize or otherwise can’t use charitable deductions may view higher IRS discount rates as a negative.)

While the current ACGA rates and the charitable deductions available to gift annuity donors are more favorable than they’ve been in many years, there are strong signs that they may have reached their peak, and their next move is likely to be downward. The IRS discount rate has declined in early 2024 and more decreases could be on the way in the coming months if the Fed follows through on its plan to lower interest rates. A further decline in interest rates could also cause the ACGA to reduce its suggested maximum annuity rates later this year. In other words, donors considering a gift annuity in 2024 may be inspired to act sooner rather than later to lock in their benefits while ACGA rates and IRS discount rates are at or near a 15-year peak they appear poised to descend from soon.