Updated 3/8/2024: Charities can now offer ACGA rates to all New York donors

A new law went into effect in New York on January 23, 2024, that revised how New York computes its maximum annuity rates. As a result, all current New York maximum annuity rates are higher than the corresponding maximum annuity rates currently suggested by the American Council on Gift Annuities (ACGA). This is good news! Charities can now offer ACGA rates to all New York donors.

Under the new law, New York will update its rates every July 1 and January 1. The ACGA updates its rates periodically, as well. It is unlikely that conflicts between New York and ACGA maximum annuity rates like the ones described below will arise again, but it could happen under certain unusual circumstances. We will update this post again if any future New York maximum annuity rates become lower than their corresponding ACGA rates.

Here’s the problem:

The ACGA, in an April 2021 communication, informed its members that the ACGA suggested maximum payout rates exceed the current maximum payout rates allowed by the State of New York at the typical ages of most gift annuitants. While there are a number of states that regulate gift annuities, New York is the only one that issues its own maximum allowable gift annuity payout rates for its residents. Until recently, the ACGA suggested maximum payout rates have been consistently lower than the New York maximum rates.

What we have determined:

Our most recent analysis reveals that, as in Q3 2022, the ACGA rates do not exceed the maximum New York rates applicable to gift annuities funded in October – December 2022 for female or male annuitants of any age. Please note, the NY maximum payout rates are published only for 1-life annuities, and they are gender-specific.

We have tested a range of two-life immediate annuities and find that the same pattern holds true for them. Hence, we are reasonably confident that charities can offer New York donors the ACGA rate for all two-life immediate annuities funded during the fourth quarter this year. The story is less straightforward for deferred gift annuities. We find that there still are some one-life and two-life deferred annuities where New York’s maximum rate is lower than the ACGA rate. We recommend that charities continue to determine New York’s maximum rate for two-life immediate annuities and one-life and two-life deferred annuities issued to New York donors in Q4 2022, and then offer the New York maximum rate or the ACGA rate, whichever is lower.

When did this begin?

New York’s methodology for determining its maximum rates changed in 2020. The state has also begun updating its maximum rates every calendar quarter, rather than annually. Hence, it appears that gifts made in Q1 2020 and onwards are affected.

What should clients use for 2-life Immediate or deferred annuities?

New York has only published 1-life rates for immediate annuities. So far as we are aware, New York has not published any guidance on rates to use for 2-life immediate or 1-life or 2-life deferred annuities. The good news is that PG Calc has worked with an actuary to determine how to perform these calculations. PG Calc customers may request from us a free calculation of the maximum payout rate for a two-life immediate annuity or one-life or two-life deferred gift annuity issued to New York residents. Just fill out this form to request a calculation.

What this means right now:

If your organization issues gift annuities to residents of the State of New York, and if you generally use the payout rates suggested by the ACGA, your payout rates for 2-life annuities and deferred annuities may exceed the New York maximums.

What should a charity do if they have already issued non-compliant gift annuities to NY donors?

So far as we are aware, New York has not published any guidance on this matter. We do not know what to advise other than asking your organization’s counsel for guidance.

New York organizations are audited every five years. What happens if non-compliant gift annuities are flagged in an audit?

We are not aware that New York has provided guidance on this topic. However, PG Calc has heard reports that non-compliant gifts have been flagged in audits, but we have not heard of fines being levied or permits revoked. Non-compliance was noted on the audit reports, which had to be circulated and acknowledged by the charity’s Board.

Will the software remind users of this issue when they attempt to generate an annuity for someone in New York?

We have added an alert about the situation with NY rates to the PGM Anywhere login screen. We have also added to PGM Anywhere and PGM a notice about the NY rates, which appears when you click Results upon creating a gift annuity agreement or gift annuity disclosure statement for a NY donor. The follow-up questions for these two narratives are the only places where the software asks for the donor’s state of residence.

Each client also can edit or add custom Disclaimers to their software. The text could be something like this: “NY rates change quarterly and often are lower than the standard rates we offer; NY donors should contact us for their current rate.” Or “These calculations are estimates of gift benefits; your actual benefits may vary. If you are considering a gift annuity and live in New York State, please contact us.”

Is PG Calc adding a software feature to calculate maximum rates for New York?

That would require a fundamental change in the way gift annuity rate lookups work in our software. We will look at that if the ACGA is not able to obtain a favorable resolution, but right now the prospects for a resolution appear good.

What should charities issuing gift annuities in New York do?

You have to look up the correct 1-life rate for each New York donor. If it is lower than the rate you would otherwise offer, you must then manually enter it into the software.

Do you have an example of how to determine the proper NY rate for a particular donor? I want to make sure I’m doing it properly.

New York now publishes rates quarterly, with the most recent quarter at the beginning of the NY Department of Financial Services PDF available from the page below. To get the current rates, choose the Present Value of Immediate Annuities . . . link to open the PDF:

https://www.dfs.ny.gov/apps_and_licensing/life_insurers/reserve_requirements

NY maximum quarterly rates apply to gift annuities made during that quarter. However, if the rates for the new quarter have not yet been published, the rate from the preceding quarter may be used. Quarterly rates are typically published by the 10th day of each quarter, but the publication date varies.

Example: A female donor, age 80, makes a gift on 10/15/21.

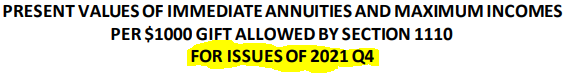

To look up the rate for a gift made on 10/15/2021, which is in Q4 2021, scroll down to find the table labeled “For Issues of 2021 Q4”:

Once you have found the correct quarterly table for your gift date, look for the gender and age of the annuitant, then take the value displayed in the “Maximum Income” column, which is 52.19, and divide by 10. Thus, the NY maximum rate for a female, age 80, making a gift on 10/15/21 is 5.219%.

In Planned Giving Manager/PGM Anywhere, manually enter 5.219% instead of the rate that is displayed, including all three decimal places. DO NOT ROUND UP – an adjusted rate that has been rounded up would exceed the statutory maximum rate; you may, on the other hand, round down or truncate the rate. In our example, for instance, you could offer 5.2%, but not 5.3%.

If the table for issues of Q4 2021 were not yet posted on the NY Department of Financial Services website on 10/15/21, you could use the table for issues of Q3 2021 instead. In that case, the NY maximum rate for a female, age 80, would be 5.424%.

What's Next?

Revised statutory language that we believe would effectively eliminate the possibility of NY’s maximum annuity rates being lower than the ACGA’s suggested maximum rates passed the New York Senate in May 2022 and is in the Insurance Committee in the New York Assembly. The New York Legislature will not be in session until January 2023, so that would appear to be the earliest that this revised statutory language could become law.

I could not resist commenting. Very well written!