A new gift planning opportunity became available at the beginning of this year thanks to the Legacy IRA Act that passed late last December: funding a charitable gift annuity (CGA) or charitable remainder trust (CRT) with a qualified charitable distribution (QCD) from one’s IRA. Gift planners were rightfully excited to have a new gift plan to talk about with their donors. However, the new gift plan’s many requirements raised doubts about how popular it would be. Who would make these gifts? Now that we are most of the way through 2023, the QCD for life income plan’s place in planned gift fundraising has become clearer.

Our Gift Administration team administers thousands of gift annuities on behalf of our clients. Our Client Services team talks with countless fundraisers and advisors every day. In their interactions with clients, both groups have noticed a recent increase in the number of new CGAs funded with a QCD. This pattern piqued our interest. To investigate the popularity of this new gift option further, we sent out a survey to a broad fundraising audience. We summarize our results below. Thank you to the more than 450 respondents who completed the survey!

1. Most Charities Have Promoted Funding a CGA or CRT with a QCD

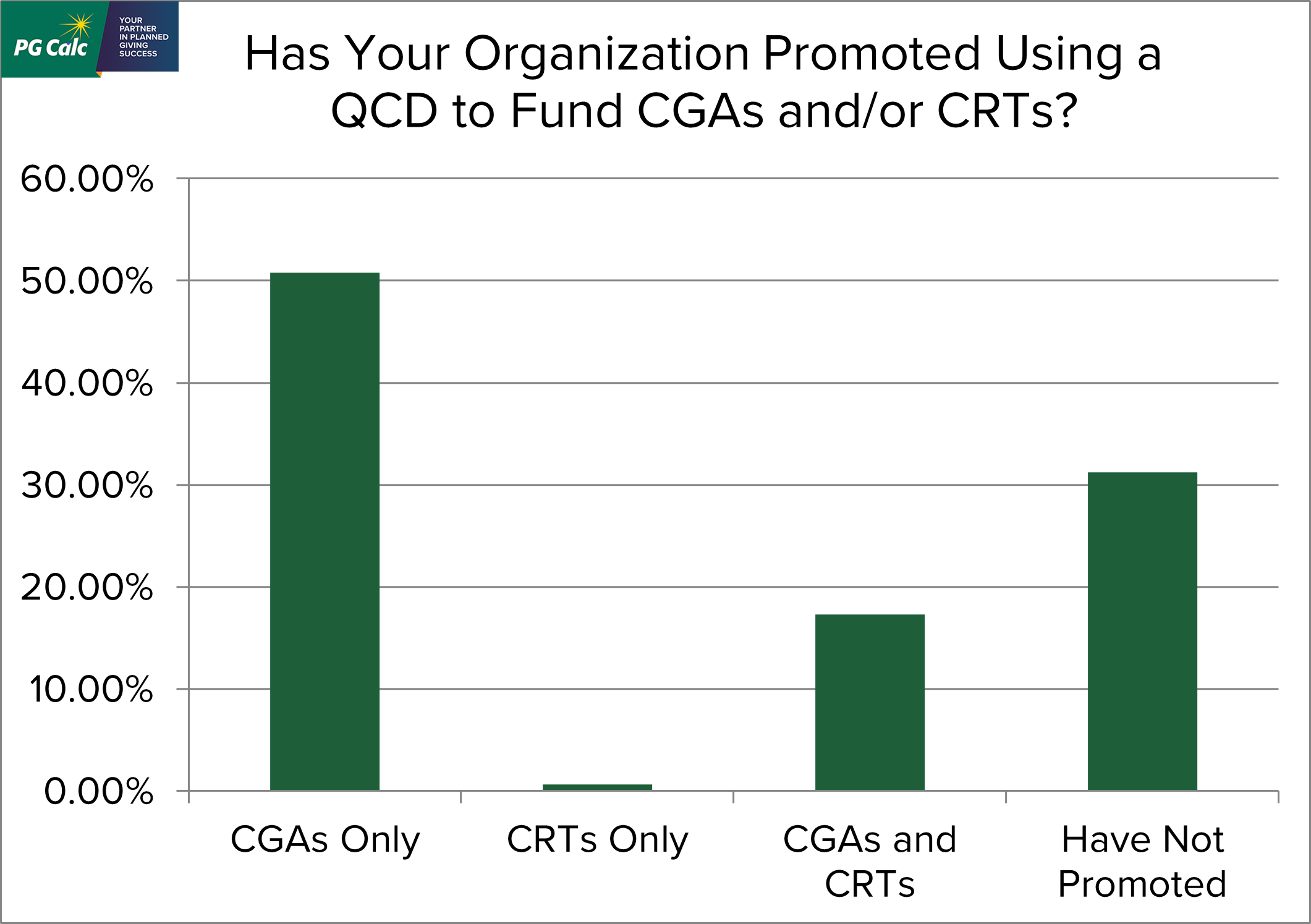

Half of our survey respondents (51%) have promoted funding a CGA with a QCD. Another sixth (17%) have promoted funding a CGA or charitable remainder trust (CRT) with a QCD. Just three in ten (31%) have not promoted this gift option at all.

2. Charities Are Being Asked About Funding a CGA or CRT with a QCD

More than three-fourths of respondents (77%) have received one or more inquiries about funding a CGA or CRT with a QCD:

| How Many Inquiries Has Your Organization Received about Using a QCD to Fund a CGA or CRT? | |

| No Inquiries | 23% |

| 1-5 Inquiries | 40% |

| 6-10 Inquiries | 20% |

| 11-25 Inquiries | 11% |

| 26-50 Inquiries | 3% |

| Over 50 Inquiries | 2% |

We didn’t ask, but based on results reviewed further below, we presume the great majority of these inquiries were about funding a CGA with a QCD, not about funding a CRT with one.

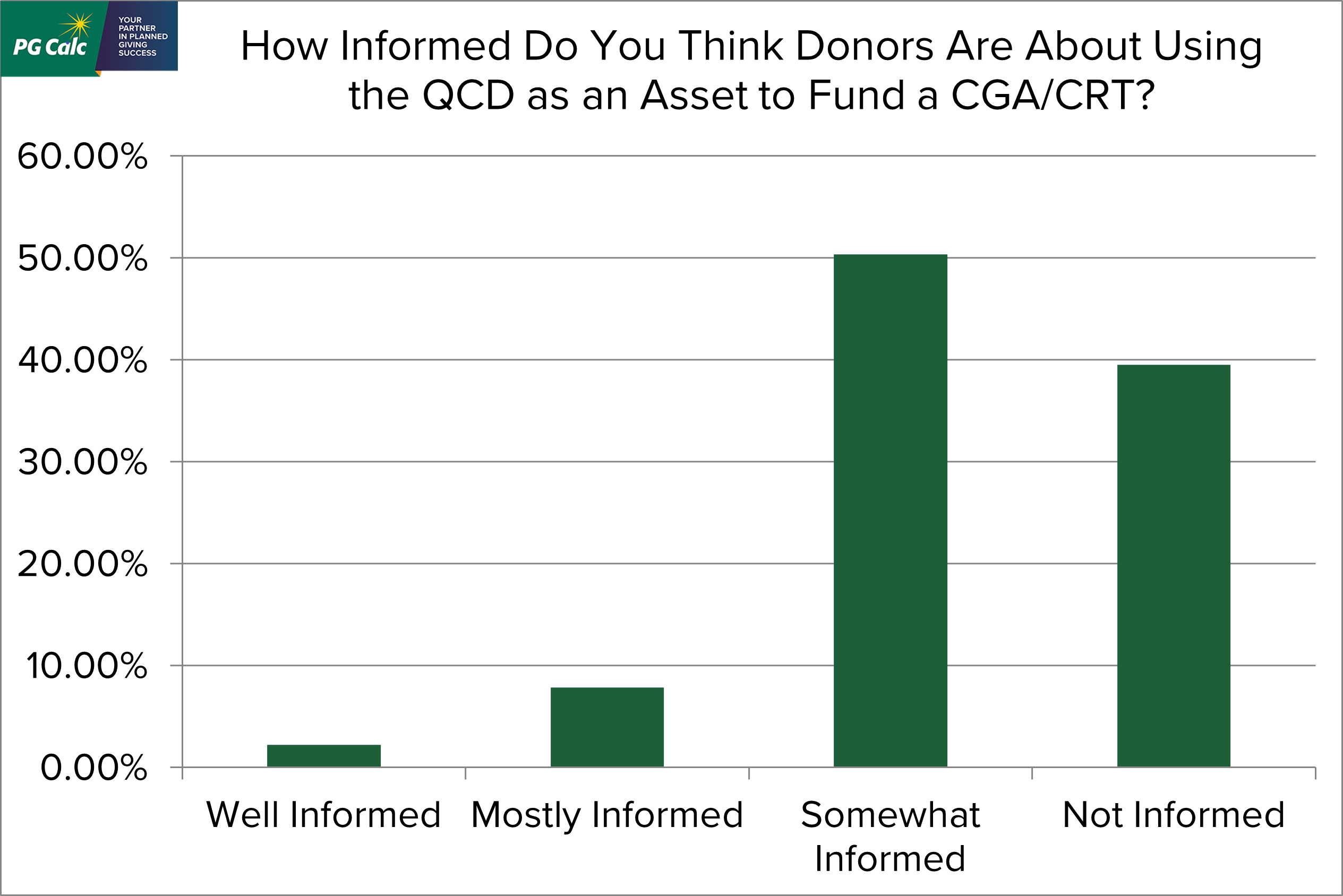

3. Donors Are Not Well Informed About Using a QCD to Fund a CGA or CRT

Nine in ten respondents (90%) reported that their donors were either “not informed” (40%) or “somewhat informed” (50%) about funding a CGA or CRT with a QCD. Just 2% felt their donors were “well informed” about this giving option. Another 8% felt donors were “somewhat informed.”

4. Nearly All Completed QCDs Are for CGAs, Not CRTs

In the “no surprise at all” department, the vast majority of life income gifts funded with a QCD have been CGAs. 220 respondents reported closing a total of 595 CGAs funded with QCDs, compared to just 42 CRTs. On average, each respondent has closed 2.3 CGAs funded with QCDs, although the middle (median) and most common (mode) responses were both just one CGA funded this way. At the high end, one respondent reported having already closed 72 CGAs funded with QCDs! Perhaps a better measure of the relative rarity of CRTs funded with QCDs is this: all the CRT gifts were reported by just five respondents, while the CGA gifts were spread among more than 200 charities.

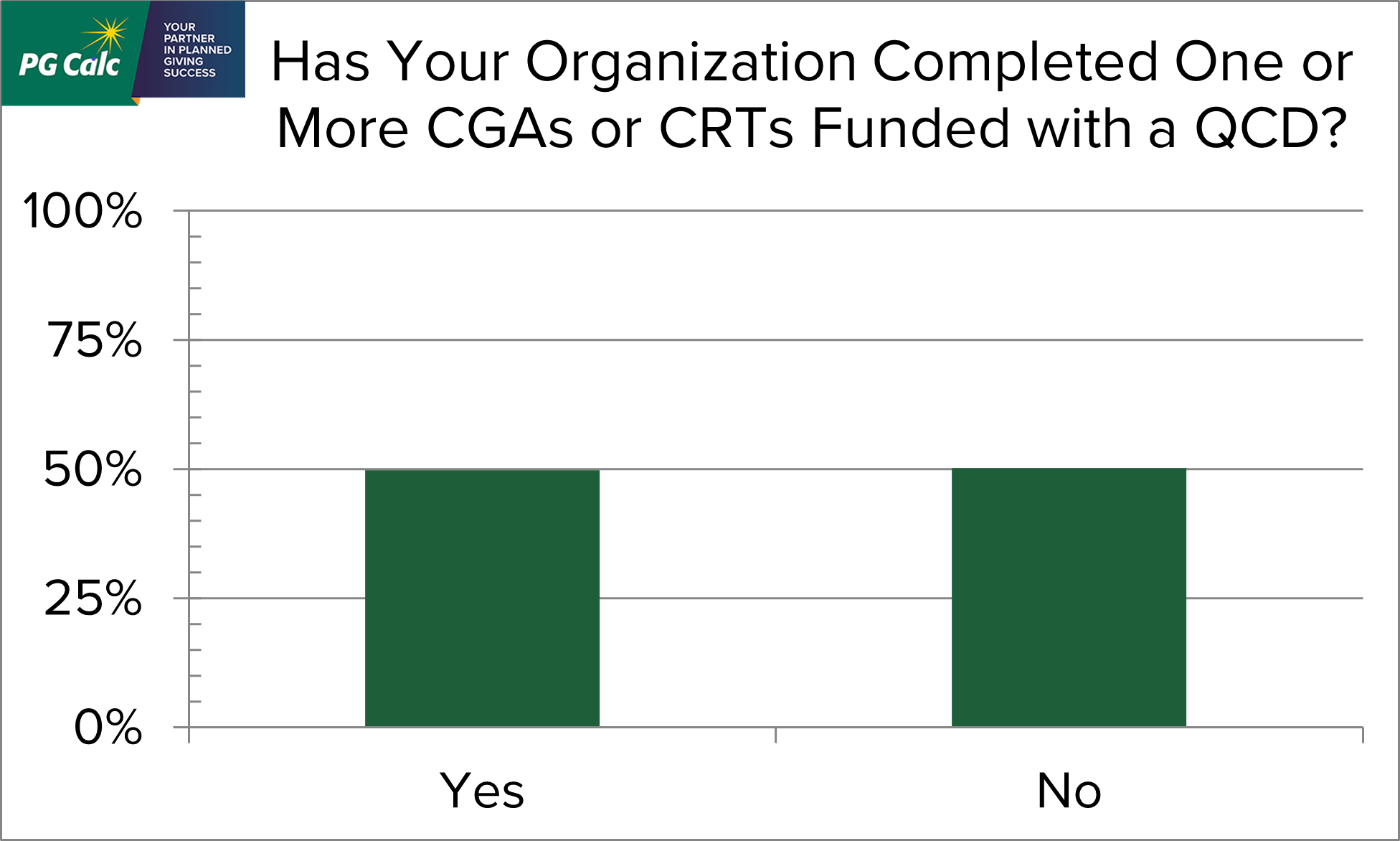

5. A Lot of CGAs Are Being Funded Using QCDs

If not already apparent from the numbers in (4) above, many charities are benefitting from CGAs funded with a QCD. Fully half of our respondents (50%) have completed at least one of these gifts.

6. The Typical Funding Amount Is $50,000, the Maximum Allowed

Over half of respondents (52%) reported $50,000 as the typical funding amount. This is the maximum amount allowed when funding a CGA or CRT with a QCD. Responses were:

| Typical Funding Amount of Life Income Gifts Funded with a QCD | |

| Less than $10,000 | 1% |

| $10,000 - $20,000 | 11% |

| $20,001 - $30,000 | 19% |

| $30,001 - $40,000 | 8% |

| $40,001 - $49,999 | 7% |

| $50,000 | 55% |

7. Occasionally, Spouses Combine QCDs to Fund a CGA or CRT with More Than $50,000

One in ten respondents (10%) reported completing at least one CGA or CRT where both spouses made QCDs so that their combined funding amount was more than $50,000. Since each spouse can give up to $50,000, their combined gift could be as much as $100,000. We did not ask whether the combined gift was to fund a CGA or a CRT.

8. Average Age of CGA Annuitants Similar to ACGA Survey Finding

Our survey respondents reported an average age of 77 for their CGA annuitants. This average is similar to the average age found by the latest American Council on Gift Annuities Survey (2021): 79. The average age reported for CRT income beneficiaries was 75, somewhat older than we think of as typical, but perhaps not surprising since the donor must be at least 70½ to fund a CGA or CRT with a QCD.

9. Reducing RMD, Spreading Out Taxes, and Receiving Payments for Life Appeal to Donors

We asked an open-response question about the primary reasons donors are completing CGAs or (rarely) CRTs funded with QCDs. Many of the roughly 100 responses mention the donor’s desire to fulfill or reduce their required minimum distribution (RMD) and spread out the tax on their withdrawal. Some also mention the appeal of receiving some income for life in exchange for the gift. Others describe donors who want to reduce the balances in their IRAs or are simply intrigued by the novelty of this new gift option. Left unsaid, but surely true, is that all these donors want to support the charities to which they are making these gifts. The benefits mentioned above are simply common reasons donors are choosing to support their charities this particular way.

Final Thoughts

The option to fund a CGA with a QCD is not just a new giving option to talk about with donors before they give some other way. A significant number of donors have made these gifts already, and the year-end giving season is still in its early stages. We expect many more CGAs to be funded with QCDs before the year is over.

The trend we are seeing and the results from our survey make clear that funding a CGA with a QCD has real appeal for many donors. Take advantage of this. Mention this giving option when discussing gift annuities with donors. Include it in your planned giving marketing. Make sure information about it is easy to find on your website. Educate your colleagues about it.

An important limitation on CGAs funded with QCDs is that a donor can make this kind of gift in only one tax year. Looking to the future, this fact raises two questions. First, what will happen with these gifts next year? Charities appear to be off to a promising start with these gifts, but none of this year’s donors will be able to make them again. How many other donors will choose to take their place next year and beyond? Second, can Congress be persuaded to remove the one-year-only limit? That probably won’t happen until after next year’s elections, if at all, but we will keep our eyes peeled for that possibility.

Funding a CGA with a QCD has turned out to be a more exciting giving technique for donors than we anticipated when this giving option first became available. That’s great! We look forward to helping our clients take advantage of the QCD CGA and to following its trajectory with future surveys.

Links to PG Calc resources on the CGA funded with a QCD:

Rules governing the QCD for life income plan

QCD annuity agreement changes and filing these agreements with states

Analysis of the financial benefits of a CGA funded with a QCD

PG Calc webinar on the Legacy IRA Act (free)