The QCD/RMD Trap Door: Act Now Before It’s Too Late!

-A qualified charitable distribution (QCD) counts toward the donor’s required minimum distribution (RMD), and that’s a great way to avoid some of the income tax on the RMD. However, some donors miss the fact that RMDs apply to all qualified retirement plans. In addition, donors may not fully understand that withdrawals from any qualified plan are taxable income unless the withdrawal is a QCD or a tax-free rollover to a different qualified plan.

So, while it’s accurate to say “your QCD will reduce the tax on your RMD,” that’s true only for the IRA account from which the QCD is made. And that’s the trap that snared your hapless donor: there is an RMD on their 401(k) which they will have to take this year. But they cannot make a QCD from a 401(k) to offset that RMD. Even worse, their retirement plan custodian cannot make a tax-free rollover to an IRA until after this year’s RMD has been withdrawn from the 401(k). Alas, it’s too late for this year but, fortunately, it’s easy to avoid this trap next year … if they act now.

QCD RMD Tool 2: A Donor Checklist for Moving Retirement Assets

-This checklist may be a helpful guide to moving their money from a 401(k), 403(b), or other non-IRA account to prepare for future QCD contributions.

You may also wish to read the associated featured article: The QCD/RMD Trap Door: Act Now Before It’s Too Late!

QCD RMD Tool 1: The Timeline – the “Year-Before” Strategy

-This visual is designed to show donors why waiting until the year they have an RMD to move their 401(k) results in an unnecessary tax bill.

You may also wish to read the associated featured article: The QCD/RMD Trap Door: Act Now Before It’s Too Late!

Navigating the Quid Pro Quo Trap – How It Affects QCDs and DAFs

-Qualified Charitable Distributions (QCDs) and Donor-Advised Funds (DAFs) are lucrative sources of philanthropic dollars available for current use. Donors often use QCDs and/or DAFs to make tax advantaged annual gifts. In addition, donors make tax smart major or even principal gifts from one of these sources. However, both QCDs and DAF grantmaking rely on donor and charity self-reporting to comply with the rules regarding permissible gifts from these sources.

It is hornbook law that a QCD to charity will only qualify as a QCD if the “entire distribution would be allowable under Section 170” as a charitable deduction. Likewise, it is universally understood that using a donor-advised fund (DAF) to make a grant for a quid pro quo donation is also prohibited. Therefore, both DAF donor advisors and QCD donors may not enjoy quid pro quo benefits that exceed the insubstantial value rules applicable to these gifts. Following tax law, even when the IRS isn’t looking, establishes the credibility and philanthropic motive underlying the preferential tax treatment of charitable gifts.

A Little Bit of IRA Mumbo Jumbo – The QCD Is Not the RMD

-The Qualified Charitable Distribution (“QCD”) from traditional IRAs is not new; it has been around since 2007. The Tax Act of 2006 ushered in this unique provision that allows distributions from traditional IRAs made directly to charities to escape the normal income tax on money taken out of a retirement plan. The donor is allowed to exclude the amount of the QCD from taxable income, but the offset is that there is no charitable income tax deduction for the gift being made to charity.

There has been confusion about the QCD ever since 2007, because it deals with aspects of IRAs that many are unfamiliar with. The biggest area of confusion has been distinguishing the RMD for a traditional IRA from a QCD. They are not the same thing. Not at all. And it is dangerous to confuse the two.

QCD Law Update: Where Are We Now, Remaining Ambiguities, and Peering into the Future

-Here we are some 20 months after the passage of the Legacy IRA Act, and questions remain. That law updated Section 408(d)(8) of the Internal Revenue Code to allow Qualified Charitable Distributions (QCD) from IRAs to fund charitable gift annuities and charitable remainder trusts. After all this time, there remains some ambiguity.

Gifts from Inherited IRAs

-A donor who inherits an IRA also inherits the ability to use the IRA to make qualified charitable distributions (QCDs), along with the limitations of this gift type.

To make a QCD contribution to charity, the beneficiary of the inherited IRA must be at least age 70 ½ at the time of the QCD. The age of the IRA’s original owner is not relevant, nor is the inheritor’s age at the time of the decedent’s death. The age that matters is that of the donor at the time they make the gift.

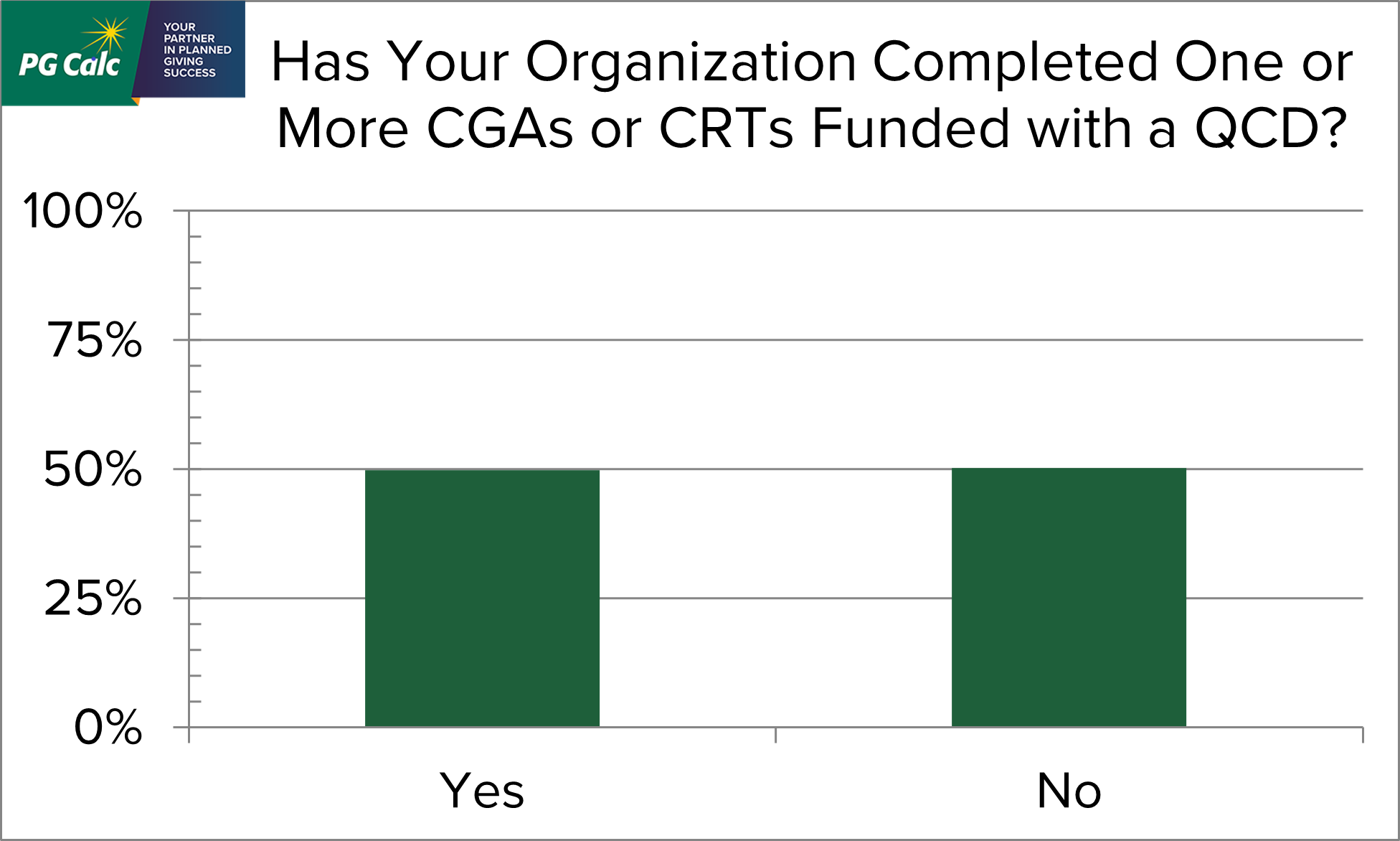

PG Calc QCD Survey: Many Charities Report Closing CGAs Funded With a QCD

-

A new gift planning opportunity became available at the beginning of this year thanks to the Legacy IRA Act that passed late last December: funding a charitable gift annuity (CGA) or charitable remainder trust (CRT) with a qualified charitable distribution (QCD) from one’s IRA. Gift planners were rightfully excited to have a new gift plan to talk about with their donors. However, the new gift plan’s many requirements raised doubts about how popular it would be. Who would make these gifts? Now that we are most of the way through 2023, the QCD for life income plan’s place in planned gift fundraising has become clearer.

A new gift planning opportunity became available at the beginning of this year thanks to the Legacy IRA Act that passed late last December: funding a charitable gift annuity (CGA) or charitable remainder trust (CRT) with a qualified charitable distribution (QCD) from one’s IRA. Gift planners were rightfully excited to have a new gift plan to talk about with their donors. However, the new gift plan’s many requirements raised doubts about how popular it would be. Who would make these gifts? Now that we are most of the way through 2023, the QCD for life income plan’s place in planned gift fundraising has become clearer.

In their interactions with clients, our Client Services and Gift Administration teams have noticed a recent increase in the number of new CGAs funded with a QCD. This pattern piqued our interest. To investigate the popularity of this new gift option further, we sent out a survey to a broad fundraising audience. We summarize our results below.

Indexing the Qualified Charitable Distribution Amount

-The index adjustment uses the average Chained Consumer Price Index for All Urban Consumers (C-CPI-U) for each calendar year with 2022 as the base year. The average for a calendar year is taken from 9/1 of the previous year through 8/31 of the current year. Indexing starts with 2024, so the first adjustment will include 9/1/2021 - 8/31/2023. A fair estimate is that there will be an inflation adjustment of 10% to 15% for that period. If that is correct, the limit on outright QCDs would be between $110,000 to $115,000 and the limit on QCDs to a CGA would be between $55,000 to $58,000 (rounded $57,500 to nearest $1,000).

QCD to Life Income Gifts (the “Legacy IRA”) Frequently Asked Questions

-What is the “Legacy IRA”? Under certain circumstances, a donor can make a one-time tax-free Qualified Charitable Distribution (QCD) from their IRA in exchange for a life income gift. This is a once in a lifetime election, subject to the limitations explained below.