Featured Articles

PG Calc publishes monthly articles on the latest topics in planned giving.

A “License to Give” – Flexible Gift Annuities for Baby Boomers

-Approximately 10,000 American baby boomers will turn 65 today. And tomorrow. And every day after that until 2030, when all baby boomers will be over the age of 65. This “gray tsunami” is predicted to set new firsts, including in the area of longevity. According to the Society of Actuaries, for a married couple who are currently both age 65, there’s a 50% chance that one spouse will live to be 90.

While longevity is on their side, the “longevity threat,” defined as outliving your retirement income, is not. Boomers started their careers at the dawn of the earliest 401k plans, and only 6% of boomers from the tail end of this gray wave have pensions (also known as a defined benefit plan). According to the Center for Retirement at Boston College, retirees who depend on a defined contribution plan, such as a 401k or 403b, are predicted to spend down their wealth more quickly than previous generations that depended on pensions. But they point out that the more a retiree’s resources come from “an annuity-like form” – including charitable gift annuities – the slower this cohort is expected to deplete their wealth. This is where a flexible deferred gift annuity (FGA) can step in to assist both the donor AND the charity with long-term planning.

Fiscal Cliff Redux

-Fifteen years ago, articles about the “fiscal cliff” were all over the news. The “fiscal cliff” referred to the looming expiration of a basket of tax reductions that had been included in the Economic Growth and Tax Relief Reconciliation Act of 2001. To pass muster with Congressional budget rules that limited the cost of that legislation, the tax reductions were set to expire on December 31, 2010. As the sunset date grew nearer, the big question was would Congress act to extend the tax reductions or allow them to expire and revert the U.S. to a higher tax regime?

Well, here we are again.

The Tax Cuts and Jobs Act of 2017 (TCJA) included a variety of changes designed to reduce federal taxes. The most dramatic of these were a doubling of the gift, estate, and generation skipping tax exemptions and of the standard deduction. The TCJA also eliminated or limited several popular itemized deductions, such as for mortgage interest (reduced from interest on the first $1 million to interest on the first $750,000) and state and local taxes (limited to $10,000 instead of unlimited). In addition, it reduced somewhat federal income tax rates and raised the income brackets at which they kicked in. In the wake of these changes, the fraction of estates that pay federal estate tax declined from an already very low 1% to a miniscule 0.1%, and the fraction of taxpayers who itemize their deductions declined from about 30% to about 10%.

Unless Congress acts, these tax reductions will expire on December 31, 2025. Donors and their advisors are beginning to plan for this possibility.

After 2023, Are We Back to Normal?

-A year ago, we published an article under the tongue-in-cheek title of “That’s Alright, It Was Only Money.” We wanted to update our understanding of historical performance results for traditional investment portfolios after the disastrous conclusion of the year 2022. We used the S&P 500 Index as the benchmark for stocks and Barclay’s Aggregate Bond Index as the benchmark for fixed income. In 2022, the former ended the year with a return of minus 13.01%, and the latter ended the year with a return of minus 19.44%. That meant our prototypical investment portfolio, invested 50% in stocks and 50% in bonds, saw a blended investment return of minus 16.23%. At the time, we pointed out that the aggregate performance for 2022 was actually worse than the aggregate performance for the Great Recession year 2008, which was “only” minus 15.88%.

And now, after another year in the books, but with quite different results in 2023, we ask the question, “Are we back to normal?” It’s probably a rhetorical question, and it begs a more specific question: “What is normal, anyway?” The S&P 500 return in 2023 was 24.23%, and the Barclays Aggregate Bond Index return was 5.53%, resulting in a blended return of 14.88%. It was a great year for investment portfolios holding traditional asset classes! The improved numbers should make everyone feel a little better off. Does it give us greater confidence to make the argument that over many years, a prudent investor strategy results in positive returns? Let’s take a look at the actual numbers.

Have Gift Annuity Benefits Peaked for Donors?

-It is no secret that the American Council on Gift Annuities (ACGA) recently increased its suggested maximum annuity rates. The new rates, which went into effect on January 1 of this year, marked the third increase in the ACGA rates in the last 18 months. At typical annuitant ages, the current rates are roughly 1.5% higher than they were in June 2022. For example, the ACGA rate for a 75-year-old annuitant was 5.4% in June 2022 and is 7.0% today.

The larger story is that today’s ACGA rates are the highest they’ve been in 15 years. What does all this mean for gift annuities?

Money Talks, But Can It Follow Instructions? The Proposed Donor Advised Fund Regulations

-Just before the holiday season began in the fall of 2023, the Treasury Department published and sought comments on proposed regulations governing donor advised funds (DAFs). Although long anticipated, the proposed regulations caught many of us off guard. Was this the opening salvo, a continuing assault on DAFs, or the final barrage? Is there more here than meets the eye or less? And what’s coming next?

For decades, donor advised funds existed in legal limbo. As funds of a public charity (the community foundation), they have operated under a web of legal concepts and regulations governing community trusts and nonprofit fund accounting. Finally, the Pension Protection Act of 2006 provided legislative direction and then, 17 years later in the fall of 2023, these proposed regulations were issued.

For the most part, the proposed regulations are focused on providing definitions, clarifying the roles and responsibilities of the parties, and clarifying the distinction between donor advised funds and private foundations. The regulatory approach, the big stick if you will, is to define certain donor advised fund distributions as taxable and apply an excise tax on them.

Stop Reading This Now!

-You read that correctly. If it is still December 2023 and you are reading this, put it aside immediately. If not, Happy New Year! Glad you remembered to come back to read this in 2024.

If you did keep reading, why on earth would we tell you to stop reading the latest in planned giving updates and information?

Except for a couple of timely updates, for everything there is a season. As we head into the end of 2023, your job is to raise as many gifts as possible.

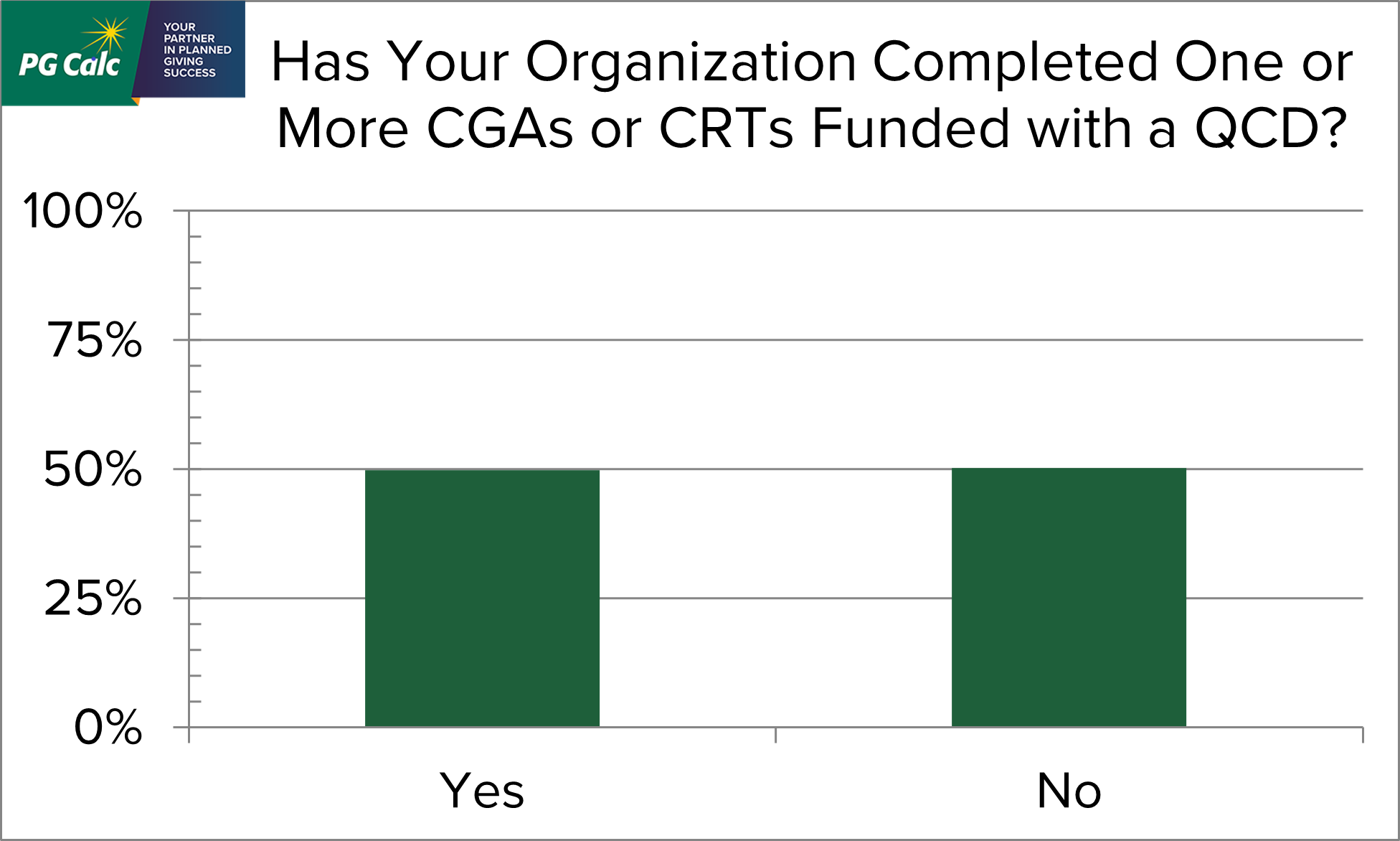

PG Calc QCD Survey: Many Charities Report Closing CGAs Funded With a QCD

-

A new gift planning opportunity became available at the beginning of this year thanks to the Legacy IRA Act that passed late last December: funding a charitable gift annuity (CGA) or charitable remainder trust (CRT) with a qualified charitable distribution (QCD) from one’s IRA. Gift planners were rightfully excited to have a new gift plan to talk about with their donors. However, the new gift plan’s many requirements raised doubts about how popular it would be. Who would make these gifts? Now that we are most of the way through 2023, the QCD for life income plan’s place in planned gift fundraising has become clearer.

A new gift planning opportunity became available at the beginning of this year thanks to the Legacy IRA Act that passed late last December: funding a charitable gift annuity (CGA) or charitable remainder trust (CRT) with a qualified charitable distribution (QCD) from one’s IRA. Gift planners were rightfully excited to have a new gift plan to talk about with their donors. However, the new gift plan’s many requirements raised doubts about how popular it would be. Who would make these gifts? Now that we are most of the way through 2023, the QCD for life income plan’s place in planned gift fundraising has become clearer.

In their interactions with clients, our Client Services and Gift Administration teams have noticed a recent increase in the number of new CGAs funded with a QCD. This pattern piqued our interest. To investigate the popularity of this new gift option further, we sent out a survey to a broad fundraising audience. We summarize our results below.

Measuring the Success of Your CGA Program: The Case for Maintaining Current Market Values for All Charitable Gift Annuities

-Charitable gift annuities (CGAs) are designed to be the split-interest gift for any donor. The basic premise is that the donor contributes cash or marketable securities to a charitable organization, and the charity promises to make payments to the donor for the rest of his or her life. The donor receives a charitable income tax deduction at the time of the gift, and some portion of the original principal remains at the donor’s passing.

That all sounds great, right? A classic “win-win-win” arrangement, and in fact, most charitable gift annuities result in a significant portion of the original principal as the residuum. When a charity has a robust gift annuity program, there can be enormous financial rewards from the ongoing stream of CGA terminations. But we’ve all heard the other side of the story as well. There are far too many examples where the gift corpus becomes completely used up, and in fact, the charity ends up kicking in money from general funds to continue making payments to an annuitant who lived beyond their original life expectancy. We call these “underwater gift annuities,” and they actually end up with negative dollar benefits.

So, what is the sum total benefit of this gift annuity venture from the charity’s perspective? Put simply, how does the charity even begin to measure the success of their CGA program?

Are You “Wasting” Your Time? Focus on Fundraising?

-Does this sound familiar? “I have to write the lead article for our newsletter by Friday. Where are those photos I want to use for the testimonial? What format should we use for our legacy society lunch? Should we hold the event at all? I need to get approval to the edits to our gift acceptance policies. Are we getting everything we are entitled to from that bequest?”

Read your job description. What is your primary responsibility? Does your title include Planned Giving Officer, Development Officer, Advancement Officer, Major Gift Officer, or similar terms? The principal concern and obligation of such a position is to attract voluntary support to advance the mission of a non-profit organization. But often, support functions prevent fundraisers from focusing on the most important part of their job: fundraising.

Funding CGAs with Mutual Funds – Is This Still a Problem?

-Americans have extensive holdings of mutual funds representing significant portions of their investment portfolios, and many invest exclusively in mutual funds. This makes sense – mutual funds are easy to purchase, simple to understand, and they allow for continuous reinvestment of dividends and income earned by the mutual fund shares. As donors review their financial assets to determine which ones to use to fund charitable gift annuities, mutual funds present an obvious choice. As an added bonus: mutual funds are easy to value for gift purposes. The share price of a mutual fund is determined daily and published as the “Net Asset Value (NAV).” A donor uses this share price to value a gift of mutual fund shares. In contrast, a gift of publicly traded securities must be computed as the average of the high and low trading prices on the date of the gift.

But gift planners should be aware of some particular aspects of mutual funds that can cause significant complications in the process.